Our CEO, Michael Ndefo, often shares the inspiring story of how he struggled to pay a supplier in China for some gadgets. He sought assistance from a bank, but was met with a plethora of requirements, including filling out Form A, obtaining a Tax Clearance Certificate and a SCUML certificate from the EFCC. Despite the tedious process, the bank informed him that USD wasn’t available and would take about three months to become available, with a payment settlement time of 3-5 days.

Frustrated by the inefficiency, slowness, and opacity of the process, Michael decided to build a product that would solve this exact problem, knowing that dozens of businesses faced the same challenges. Today, AmaPay offers fast, reliable, easy, secure, and cost-effective international payments for businesses, with quick settlements within 24 hours across 100+ countries worldwide.

One of the terrible yet fascinating problems we’re solving at AmaPay in inter-Africa trade is what I call the “merry-go-round”.

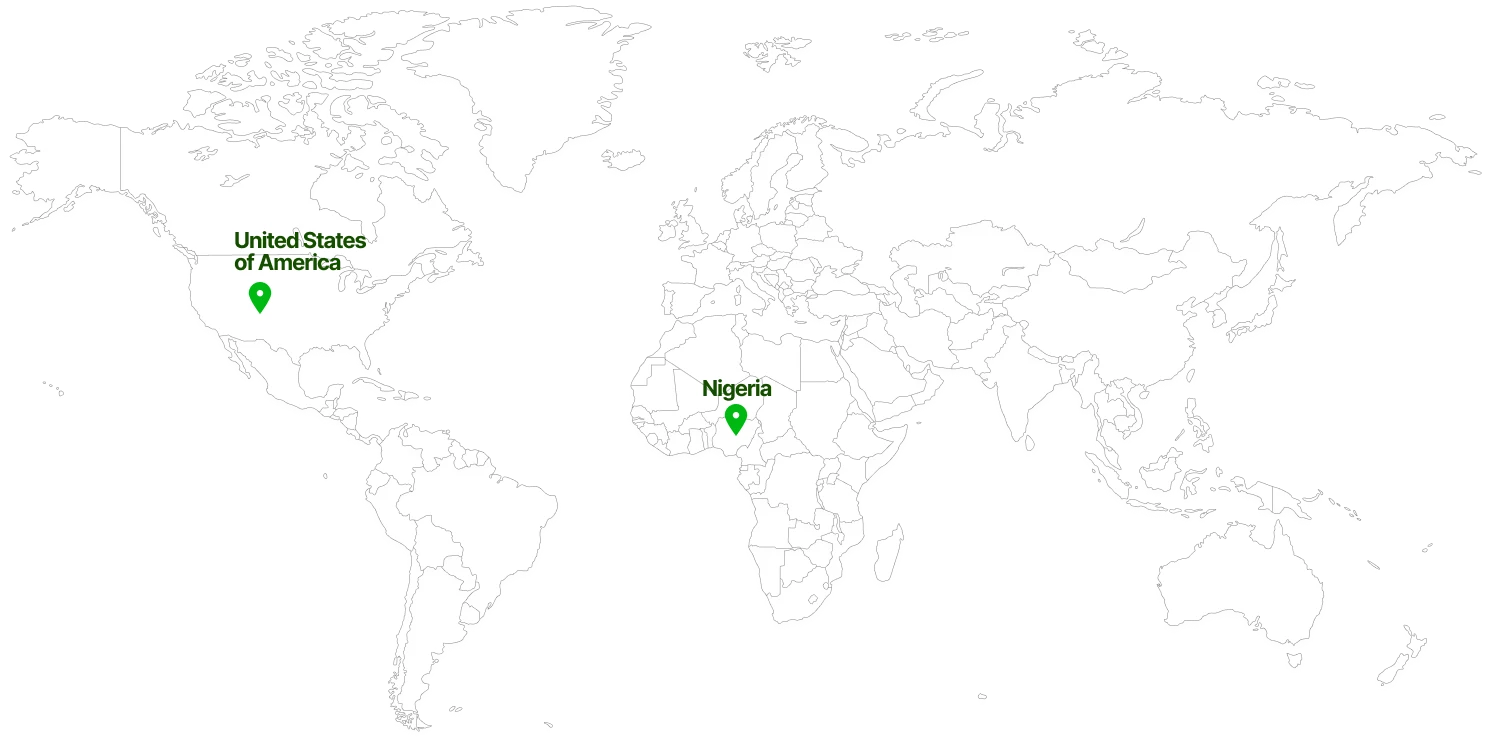

Long before AmaPay was founded, payments from one African country had to go through the US or Europe to reach their destination in another African country, making inter-Africa payments very slow and prolonging a single transaction to take weeks to conclude. This is because the traditional payment infrastructure in Africa is fragmented and outdated, and was never designed by colonial powers to facilitate payments between African countries, but rather to facilitate payments from the US or Europe into Africa.

At AmaPay, we are solving this catastrophic problem by building an innovative payment infrastructure and establishing solid strategic partnerships with local banks and financial institutions across the 50 African states. This is indeed historic, as we work day and night with the entire AmaPay team to fix payment-related problems and barriers to seamless inter-Africa trade.

In full support of the AfCFTA, its policies, strategic moves, and economic integration among African countries, and the payment, liquidity, and financing infrastructure we’re building at AmaPay, inter-Africa’s share of Africa’s trade is set to skyrocket from just 15% to a bigger share! As we know, Asia’s share of Africa’s trade is 60%, and Europe’s is 70%, which shows a huge gap in inter-Africa trade.

I believe that strengthening the inter-Africa share of Africa’s trade will require different players, including policymakers, business builders, financial institutions, and regulators, to work together to make this continent great again, like in the days of old before colonial times.

Please complete the form with the required information, and we’ll be in touch shortly.

Please complete the form with the required information, and we will contact you shortly.